インドネシア進出における法務の基礎と全体像

Attorney-at-law admitted in Indonesia

Fiesta Victoria

Attorney admitted in Japan

Kenta Muroi

The Early Business Recovery Act, enacted in June 2025, establishes a new out-of-court restructuring framework for adjusting debts owed to financial institutions and other creditors. In Part I of this series (“[To Take Effect in 2026] The New Out-of-Court Restructuring Scheme under the Early Business Recovery Act (Part I) – Overview and Key Points”), we outlined the background of the Act and its key features, including how it differs from other rehabilitation procedures. In this Part II, we will explain the procedural flow of the new framework and highlight important practical considerations for its use.

![[To Take Effect in 2026] The New Out-of-Court Restructuring Scheme under the Early Business Recovery Act (Part II) – Procedural Flow and Practical Considerations](https://zelojapan.com/wp/wp-content/uploads/2025/09/f77e871da91de39aafc7fd35c7eae8cf.jpg)

Graduated from the University of Tokyo Faculty of Law in 1997 and registered as a lawyer (Japan) in 2000 (member of the Tokyo Bar Association). After working at Nagashima Ohno & Tsunematsu, Porter, Wright, Morris & Arthur (U.S.), and Clifford Chance LLP, he joined ZeLo Foreign Law Joint Enterprise in 2020. His practice focuses on general corporate, investment, start-up support, finance, real estate, financial and other regulatory matters. In addition to domestic cases, he also handles many overseas cases and English-language contracts. He is also an expert in FinTech, having authored the article "Fintech legislation in recent years" in the Butterworths Journal of International Banking and Financial Law. His other major publications include "Japan in Space - National Architecture, Policy, Legislation and Business in the 21st Century" (Eleven International Publishing, 2021). Publishing, 2021).

Graduated from the Faculty of Law, Waseda University in 2009, and completed the School of Law at the University of Tokyo in 2012. Registered as a lawyer in 2013 (Daini Tokyo Bar Association). Joined The Tokyo Marunouchi Law Offices in 2014, and became a member of ZeLo in February 2018. His main practice includes business restructuring and insolvency, M&A, fintech, startup support, general corporate matters, labor and employment, and litigation and dispute resolution. He is the author of publications such as "Strategy and Practice of Rulemaking" (Shojihomu, 2021).

Graduated from the University of Tokyo, Faculty of Law in 2021. Completed the University of Tokyo School of Law and passed the bar exam in 2023. Registered as an attorney (Daini Tokyo Bar Association) and joined ZeLo in 2025. His practice areas include M&A, startup/venture law, startup finance, startup investment, litigation/dispute resolution, unfair trading (financial regulations/insider trading), cybersecurity, fintech, AI, data protection, financial law/funds, real estate, and restructuring bankruptcy.

目次

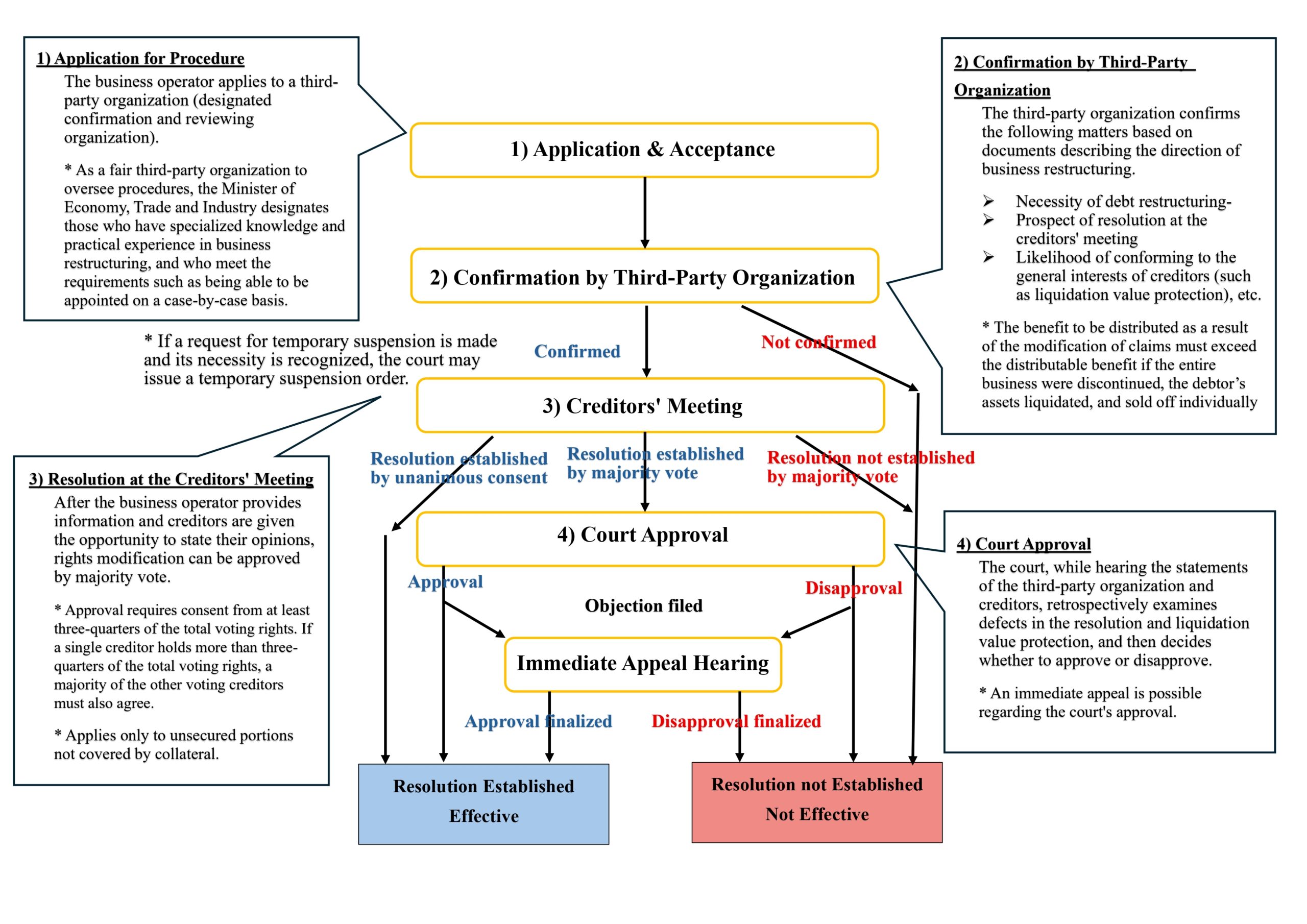

The general flow of business rehabilitation procedures under the Early Business Recovery Act (the “Procedure”) is illustrated in the following chart:

First, when a business operator facing the risk of financial distress seeks to adjust its obligations to financial creditors through a resolution at a creditors’ meeting, the operator must apply to a “Designated Confirmation and Review Organization,” which is a fair and independent third party designated by the Minister of Economy, Trade and Industry.

At the time of application, the debtor is required to submit a prescribed application form along with documents such as a summary of the proposed modification of the financial obligations (the “Debt Adjustment Summary”); and a list of the relevant financial obligations (the “List of Loan Claims, etc.”).

Based on the submitted documents, the Designated Confirmation and Review Organization will examine:

All of the statutory requirements set out in Article 3.I must be satisfied in order for the confirmation to be granted.

Once this confirmation has been made, the Designated Confirmation and Review Organization will notify each financial creditor individually (Article 3.VII). This confirmation marks the formal commencement of the Procedure and fixes the reference date for determining the scope and amount of the eligible creditors and claims (Articles 2.III and 2.IV).

Following the confirmation described above, the Designated Confirmation and Review Organization must promptly request all eligible creditors to refrain from exercising their rights as creditors with respect to the collection and enforcement of eligible debts (a “Suspension Request”), and must notify the debtor that such a request has been made (Article 6.I). From the time the debtor receives notice of the Suspension Request, repayment of eligible debts is subject to restrictions (Article 6.II).

Although the Suspension Request itself does not carry binding legal force, eligible creditors are under a duty of good faith to cooperate in facilitating the smooth implementation of the Procedure when such a request is made by the debtor or the Designated Confirmation and Review Organization (Article 6.III).

If an eligible creditor seeks to collect or otherwise enforce its claim in violation of a Suspension Request, the debtor or other eligible creditors may petition the court for an order to suspend compulsory execution (Article 7) or an order to suspend enforcement of security rights (Article 8). In addition, where some eligible creditors recover their claims in violation of a Suspension Request, the Early Business Recovery Plan (i.e., the Debt Adjustment Resolution) may provide for special measures concerning such creditors’ claims (Article 13, proviso), thereby ensuring equitable treatment among creditors.

After the confirmation by the Designated Confirmation and Review Organization, the debtor must, in principle within six months (subject to a possible extension of up to an additional six months in cases of unavoidable circumstances), prepare and submit to the Designated Confirmation and Review Organization both:

Required Contents of the Early Business Recovery Plan (Article 14.III)

The Early Business Recovery Plan must set out, among other matters:

The debtor is also required to attach to the application a property valuation report (the “Property Valuation Report”), which assesses the value of the debtor’s assets and liabilities in accordance with standards set by ministerial ordinance.

Required Contents of the Debt Adjustment Resolution (Article 12)

The Debt Adjustment Resolution must specify, at a minimum:

The Designated Confirmation and Review Organization conducts an investigation to determine whether the contents of the submitted Debt Adjustment Resolution, the Early Business Recovery Plan, and the Property Valuation Report meet the following requirements (Article 15.I). The debtor is obligated to cooperate with the investigation conducted by the Designated Confirmation and Review Organization (Article 15.III):

The Designated Confirmation and Review Organization must report the results of its investigation to the debtor (Article 15.IV). The debtor, in turn, is obligated to deliver this investigation report to the eligible creditors as a reference document for the exercise of their voting rights at the subsequent creditors’ meeting (Article 17.I).

Upon receiving the investigation report from the Designated Confirmation and Review Organization, the debtor must, without delay, convene a meeting of eligible creditors to deliberate and resolve on the Debt Adjustment Resolution (Articles 16.I, 16.II).

When convening the creditors’ meeting, the debtor must specify the date, the matters to be resolved, and, where creditors who do not attend are permitted to exercise their voting rights by electronic means, a statement to that effect, along with other matters prescribed by ministerial ordinance (Article 16.III). In addition, within the period specified by ministerial ordinance, the debtor must provide written notice of these matters to the eligible creditors and to the Designated Confirmation and Review Organization, together with the Debt Adjustment Resolution, the Early Business Recovery Plan, the investigation report of the Designated Confirmation and Review Organization, and the written voting forms required for creditors to exercise their voting rights (Articles 16.IV, 16.VI, 17.I).

At the creditors’ meeting, only the Debt Adjustment Resolution is subject to a vote; the Early Business Recovery Plan itself is not put to a resolution. For the Debt Adjustment Resolution to be approved, it must obtain the consent of creditors holding at least three-fourths of the total voting rights in respect of the eligible debts (Article 20.I, main text). However, if a single creditor holds three-fourths or more of the total eligible claims, approval also requires the consent of a majority in number of the creditors who exercised their voting rights (Article 20.I, proviso).

For the purposes of calculating voting rights, the amount of claims held by eligible creditors constitutes the voting rights (Article 19.I). The calculation is based on the portion of claims not secured by security interests (Article 19.III), and interest and damages accruing after confirmation by the Designated Confirmation and Review Organization are excluded (Article 19.II).

When a Debt Adjustment Resolution has been adopted at the creditors’ meeting (except in cases where unanimous consent of all eligible creditors has been obtained with respect to the Debt Adjustment Resolution), the debtor must, without delay, file a petition with the court for confirmation of the resolution. In doing so, the debtor is required to submit both the Early Business Recovery Plan and the investigation report prepared by the Designated Confirmation and Review Organization (Article 26.I). Notably, pursuant to the Supreme Court Rules, the petition may be filed by means of an electronic record (such as electronic submission of documents or the submission of an electronic storage medium) instead of in paper form (Article 26.II).

Upon receiving such a petition, the court will grant a decision confirming the Debt Adjustment Resolution, unless one of the following grounds applies (Articles 27.I, II):

The Debt Adjustment Resolution becomes effective upon the court’s decision of confirmation (Article 28.I). Once effective, the resolution is binding upon the debtor and all eligible creditors, including those who opposed the resolution (Articles 28.I, 28.II, 28.IV). Importantly, the resolution does not affect creditors’ rights against guarantors of the debtor or against assets provided as collateral (Article 28.III).

If unanimous consent of all eligible creditors is obtained with respect to the Debt Adjustment Resolution, the resolution becomes effective immediately upon such consent, and no petition for court confirmation is required (Article 29).

The Procedure will terminate when the effect of the Debt Adjustment Resolution has become final and binding—namely, either when all eligible creditors entitled to vote have given their consent at the creditors’ meeting, or when the court’s confirmation decision regarding the Debt Adjustment Resolution has become final (Articles 26 and 27).

In addition, the Procedure will terminate in the following circumstances:

The Procedure can serve as an effective tool in the following types of cases:

In the following types of cases, it is highly likely that the Procedure will not serve as an effective tool, and the use of alternative procedures should be considered instead:

The Early Business Recovery Act represents a groundbreaking initiative to facilitate the early recovery of Japanese enterprises and is expected to have a significant impact on future practice in out-of-court restructuring. Going forward, it will be important to continue monitoring the development of subordinate regulations and practical implementation trends.

At ZeLo, we have attorneys with extensive experience in the fields of business recovery and insolvency. The sooner a company begins its restructuring efforts, the greater the range of available options. We provide comprehensive advice and tailored services suited to the needs of each case, and we encourage you to contact us for further consultation.

![[To Take Effect in 2026] The New Out-of-Court Restructuring Scheme under the Early Business Recovery Act (Part II) – Procedural Flow and Practical Considerations](https://zelojapan.com/wp/wp-content/uploads/2021/08/img_zls_cta_left-1-1440x640.jpg)

![[To Take Effect in 2026] The New Out-of-Court Restructuring Scheme under the Early Business Recovery Act (Part II) – Procedural Flow and Practical Considerations](https://zelojapan.com/wp/wp-content/uploads/2021/08/img_zls_cta_right-1-1440x640.jpg)