インドネシア進出における法務の基礎と全体像

Attorney-at-law admitted in Indonesia

Fiesta Victoria

Attorney admitted in Japan

Kenta Muroi

In June 2025, the “Early Business Recovery Act” was enacted, introducing a new out-of-court restructuring framework designed for debt adjustments with financial institutions and other creditors. Traditionally, private workout procedures required the unanimous consent of all creditors, and it was not uncommon for a small number of dissenting creditors to block a restructuring. Under the new scheme, a workout can be approved by majority consent, enabling a quicker and more flexible path to business rehabilitation. This article, presented in two parts, provides an overview of the Early Business Recovery Act. In Part I, we will explain the Act’s key features and highlight how it differs from other rehabilitation procedures.

![[To Take Effect in 2026] The New Out-of-Court Restructuring Scheme under the Early Business Recovery Act (Part I) – Overview and Key Points](https://zelojapan.com/wp/wp-content/uploads/2025/09/c5f94a8ddff50d5a6a04daf9ef7638b2.jpg)

Graduated from the University of Tokyo Faculty of Law in 1997 and registered as a lawyer (Japan) in 2000 (member of the Tokyo Bar Association). After working at Nagashima Ohno & Tsunematsu, Porter, Wright, Morris & Arthur (U.S.), and Clifford Chance LLP, he joined ZeLo Foreign Law Joint Enterprise in 2020. His practice focuses on general corporate, investment, start-up support, finance, real estate, financial and other regulatory matters. In addition to domestic cases, he also handles many overseas cases and English-language contracts. He is also an expert in FinTech, having authored the article "Fintech legislation in recent years" in the Butterworths Journal of International Banking and Financial Law. His other major publications include "Japan in Space - National Architecture, Policy, Legislation and Business in the 21st Century" (Eleven International Publishing, 2021). Publishing, 2021).

Graduated from the Faculty of Law, Waseda University in 2009, and completed the School of Law at the University of Tokyo in 2012. Registered as a lawyer in 2013 (Daini Tokyo Bar Association). Joined The Tokyo Marunouchi Law Offices in 2014, and became a member of ZeLo in February 2018. His main practice includes business restructuring and insolvency, M&A, fintech, startup support, general corporate matters, labor and employment, and litigation and dispute resolution. He is the author of publications such as "Strategy and Practice of Rulemaking" (Shojihomu, 2021).

Graduated from the University of Tokyo, Faculty of Law in 2021. Completed the University of Tokyo School of Law and passed the bar exam in 2023. Registered as an attorney (Daini Tokyo Bar Association) and joined ZeLo in 2025. His practice areas include M&A, startup/venture law, startup finance, startup investment, litigation/dispute resolution, unfair trading (financial regulations/insider trading), cybersecurity, fintech, AI, data protection, financial law/funds, real estate, and restructuring bankruptcy.

目次

The “Act on Financial Debt Adjustment Procedures for Enterprises to Facilitate Business Recovery” (commonly referred to as the Early Business Recovery Act) was approved by the Cabinet on March 4, 2025, submitted to the 217th session of the Diet, and enacted into law on June 6, 2025.

The Act establishes a new framework aimed at allowing business operators facing potential financial distress to begin recovery efforts at an early stage. Its objective is to prevent deterioration of enterprise value and the loss of essential technology and human resources.

Under this scheme, with the involvement of a fair and independent third party designated by the Minister of Economy, Trade and Industry (the “Designated Confirmation and Review Organization”), debt adjustments can be carried out exclusively with respect to financial debts. Approval requires the consent of creditors representing at least three-fourths of the total voting rights, as well as confirmation by the court. Importantly, the adjustment will also apply to dissenting creditors.

Through this process, the Act enables businesses to restructure their financial liabilities in a timely and efficient manner, while maintaining the flexibility of an out-of-court restructuring framework.

In recent years, the outstanding debt of Japanese companies has increased by more than JPY 120 trillion compared to pre-COVID-19 levels, and in 2024 the number of corporate insolvencies exceeded 10,000 for the first time in 11 years.[1] Rising raw material costs, labor shortages, the depreciation of the yen, high inflation, and higher borrowing costs resulting from monetary policy adjustments have all converged to increase the debt burden on companies. This has constrained business activities aimed at improving profitability and raised concerns that more companies will miss opportunities for recovery and be forced into bankruptcy.

In light of these economic and social conditions, the establishment of a framework enabling businesses facing potential financial distress to commence recovery efforts at an early stage has become an urgent policy priority. The aim is to prevent the destruction of enterprise value and the outflow of key technology and human resources, while also reinforcing the economy’s renewal functions.

Existing business recovery procedures, however, presented challenges. Legal insolvency proceedings such as civil rehabilitation (minji saisei) require public notice and apply to all claims, including trade claims. As a result, such procedures often exacerbate the deterioration of business value and profitability.

By contrast, out-of-court restructuring schemes such as the Business Rehabilitation ADR system, the Small and Medium-Sized Enterprise Revitalization Support Councils, the Guidelines for Business Revitalization of Small and Medium-Sized Enterprises (the “SME Revitalization Guidelines”), and the Regional Economy Vitalization Corporation of Japan (REVIC) do not require public notice and generally apply only to financial debt. These schemes are therefore less disruptive to business value and commercial relationships. However, because they require the unanimous consent of all affected creditors, even a single dissenting creditor can obstruct restructuring efforts, making early rehabilitation difficult. In practice, there have been cases where creditors refused to accept fundamental restructuring proposals under out-of-court restructuring procedures, insisting instead on rescheduling arrangements, thereby delaying or preventing meaningful business rehabilitation.

While the idea of introducing majority rule into out-of-court restructuring procedures for financial creditors has long been discussed, it was against this backdrop that the Early Business Recovery Act was ultimately enacted.

Under the procedure established by the Early Business Recovery Act (the “Procedure”), if creditors holding at least three-fourths of the total amount of eligible unsecured claims (i.e., claims not secured by collateral) consent, the out-of-court restructuring is deemed to have been approved. With subsequent court confirmation, the debt adjustment, including reduction, discharge, or extension of payment deadlines, becomes binding even on dissenting creditors (Article 20.I, main text; Article 28).

Where a single creditor holds three-fourths or more of the eligible claims, approval additionally requires the consent of a majority of the creditors who exercised their voting rights (Article 20.I, proviso).

The Early Business Recovery Act is scheduled to come into effect on a date to be specified by Cabinet Order within 18 months from the date of promulgation (June 13, 2025) (Supplementary Provision, Article 1). Accordingly, the Procedure is expected to become available for use during 2026.

The Procedure may be used by any “business operator facing the risk of financial distress” (Articles 1, 3.I), whether incorporated or unincorporated. However, it is not available to individuals who are not engaged in business activities. Likewise, the Procedure cannot be used for the resolution of personal guarantee obligations owed by company representatives or other individuals who have guaranteed a business operator’s debts.

The creditors subject to the Procedure (Article 2.IV) are limited to “financial institutions, etc.” (Article 2.I). The claims subject to the Procedure (Article 2.III) are limited to “loan claims, etc.” held by such financial institutions (Article 2.II). Furthermore, the claims that may be modified are restricted to unsecured claims that are not secured by collateral (Article 11, parenthetical clause).

As noted above, eligible debtors are defined as “business operators facing the risk of financial distress.” This means the Procedure can be utilized at an earlier stage than civil rehabilitation proceedings, which are available only to “debtors in financial distress” (Civil Rehabilitation Act, Articles 1 and 2.I), or corporate reorganization proceedings, which are available only to “distressed stock companies” (Corporate Reorganization Act, Article 1).

In practice, it is envisioned that the Procedure may be invoked from the very outset of an out-of-court restructuring process. As discussed further in Part II of this article, once the Procedure is initiated (with confirmation by a designated third-party institution), requests can be made to the relevant creditors for temporary standstill measures.

That said, it is also anticipated that many debtors may first attempt other out-of-court restructuring procedures such as Business Rehabilitation ADR, SME Revitalization Councils, or the SME Revitalization Guidelines and only turn to this Procedure where unanimous creditor consent cannot be achieved, thereby using the new framework to secure majority approval and final court confirmation for a restructuring.

In the Procedure, the court becomes involved only in two stages: (i) when issuing a suspension order (Articles 7 and 8) and (ii) when granting confirmation of a resolution (Article 27). This is in clear contrast to civil rehabilitation and corporate reorganization proceedings, where the court plays a central and extensive role throughout the process, and it also distinguishes the Procedure from other out-of-court restructuring, in which the court is not involved at all.

Because debt modifications are effected by majority resolution, it is necessary to ensure the legitimacy of the process within certain bounds. At the same time, given that the creditors subject to the Procedure are limited to financial institutions and similar entities, the framework is deliberately designed to remain simple so as to enable an effective and practical out-of-court restructuring.

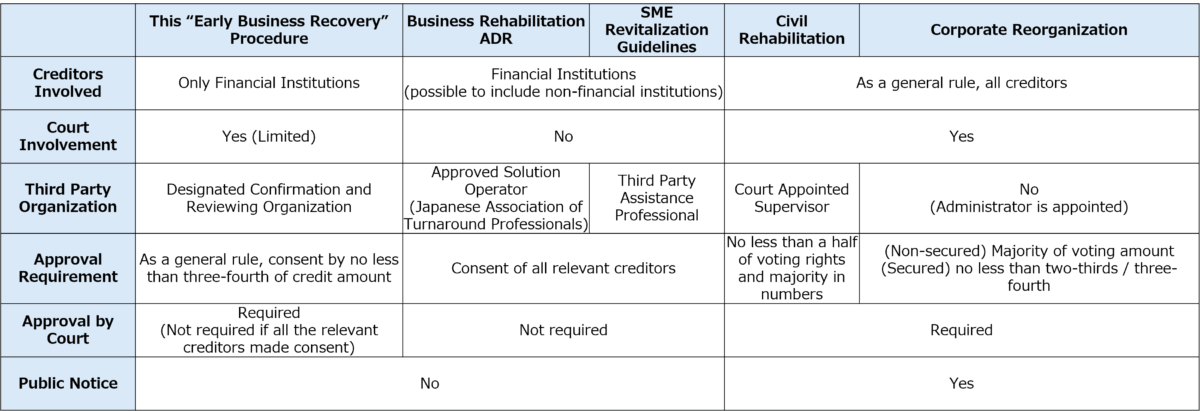

The following table summarizes the main differences between the Procedure and other major business rehabilitation frameworks (Business Rehabilitation ADR, the SME Revitalization Guidelines, Civil Rehabilitation, and Corporate Reorganization):

As outlined above, this article has focused on the overview and key features of the Early Business Recovery Act. In Part II, we will turn to the procedural flow and practical use cases.

At ZeLo, we have attorneys with extensive experience in business recovery and insolvency matters. The earlier a company takes steps toward restructuring, the broader the range of available options. We provide comprehensive advice and tailored services to meet the needs of each case. Please feel free to contact us to discuss your situation.

Sources:

[1] https://www.meti.go.jp/press/2024/03/20250304003/202503004003.html

![[To Take Effect in 2026] The New Out-of-Court Restructuring Scheme under the Early Business Recovery Act (Part I) – Overview and Key Points](https://zelojapan.com/wp/wp-content/uploads/2021/08/img_zls_cta_left-1-1440x640.jpg)

![[To Take Effect in 2026] The New Out-of-Court Restructuring Scheme under the Early Business Recovery Act (Part I) – Overview and Key Points](https://zelojapan.com/wp/wp-content/uploads/2021/08/img_zls_cta_right-1-1440x640.jpg)