Overview of Carbon Credits (Part 2) – Legal Framework and Key Considerations –

Attorney admitted in Japan, NY

Satoshi Nomura

Attorney admitted in Japan

Ryuichi Ito

In October 2020, the Japanese government declared its goal of achieving carbon neutrality by 2050, accelerating efforts toward this objective. Carbon neutrality, as defined by the government, refers to a state where human-caused greenhouse gas emissions are balanced by the removal of such gases. To achieve carbon neutrality, reducing emissions through measures such as the adoption of renewable energy is essential. However, even with significant reductions, some emissions remain unavoidable. This is where the concept of carbon offsetting comes into play—investing in initiatives that reduce greenhouse gases to compensate for emissions. In this context, the use of carbon credits has been gaining attention. Most recently, in October 2023, the Tokyo Stock Exchange launched a carbon credit market, further increasing interest in carbon credits. This article will provide an overview of carbon credits and their growing significance.

Graduated from the University of Tokyo Faculty of Law in 1997 and registered as a lawyer (Japan) in 2000 (member of the Tokyo Bar Association). After working at Nagashima Ohno & Tsunematsu, Porter, Wright, Morris & Arthur (U.S.), and Clifford Chance LLP, he joined ZeLo Foreign Law Joint Enterprise in 2020. His practice focuses on general corporate, investment, start-up support, finance, real estate, financial and other regulatory matters. In addition to domestic cases, he also handles many overseas cases and English-language contracts. He is also an expert in FinTech, having authored the article "Fintech legislation in recent years" in the Butterworths Journal of International Banking and Financial Law. His other major publications include "Japan in Space - National Architecture, Policy, Legislation and Business in the 21st Century" (Eleven International Publishing, 2021). Publishing, 2021).

Ryuichi Ito joined ZeLo in 2022. Before joining ZeLo, he started his career as a lawyer by joining Nishimura & Asahi in 2018. He graduated from the University of Tokyo (LL.B) and passed Japanese Bar Exam in 2017. His main areas of practice include startup law, competition law, public affairs etc.

目次

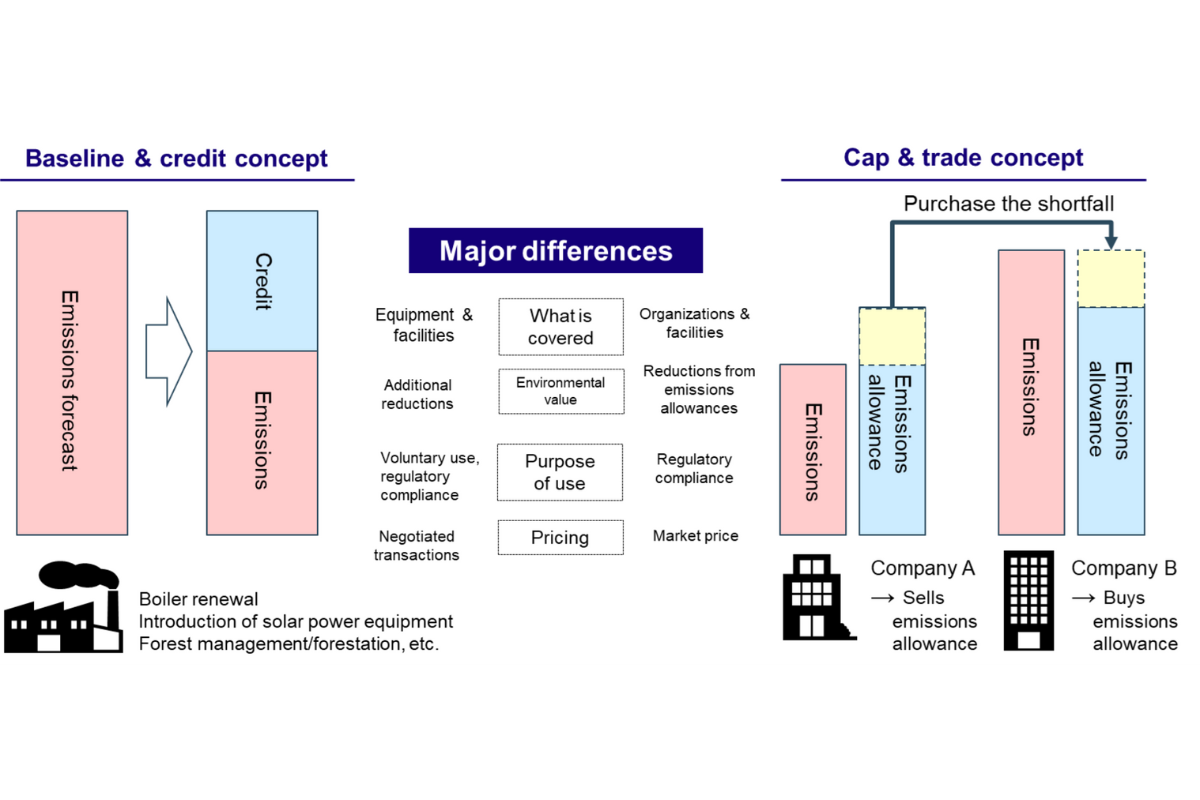

The definition of carbon credits varies, but according to the Carbon Credit Report published in June 2022 by the Study Group on the Establishment of an Environment for the Proper Utilization of Carbon Credits toward Carbon Neutrality (Carbon Credit Study Group), carbon credits are recognized based on the baseline-and-credit approach. Under this approach, when actual emissions fall below projected emissions (the baseline), the difference is certified as credits through a process of monitoring, reporting, and verification (MRV).

For example, in a project that converts heavy oil boilers to city gas boilers, the projected emissions from continued use of heavy oil boilers serve as the baseline, and the reduction achieved by switching to city gas boilers is certified as carbon credits.

Buyers of carbon credits can utilize the purchased credits for voluntary offsetting or for compliance with regulatory reporting requirements, such as those under the Act on Promotion of Global Warming Countermeasures (温対法).

Emissions Trading Scheme

A related system to carbon credits is the Emissions Trading Scheme (ETS). Under an ETS, a public authority sets an emission allowance for specific organizations or facilities. If actual emissions exceed this allowance, the entity must purchase emission permits from companies that have kept their emissions below their allocated limit. This system is based on the cap-and-trade approach.

Furthermore, in emissions trading schemes across various countries and regions, it is common for companies to be allowed not only to purchase emission permits from participating entities but also to acquire and utilize carbon credits from non-participating companies.

Carbon credits can be broadly categorized based on their issuing entities. They include:

Types of Carbon Credits

| Type | Overview |

|---|---|

| J-Credit | The J-Credit system, launched in 2013, evolved from the integration of the Offset Credit (J-VER: Japan-Verified Emission Reduction) System, established in November 2008, and the Domestic Credit System (Certified Domestic Emission Reduction System). It is a domestic Japanese program managed by the Ministry of Economy, Trade and Industry (METI), the Ministry of the Environment (MOE), and the Ministry of Agriculture, Forestry and Fisheries (MAFF). The system certifies credits for greenhouse gas (GHG) reduction and absorption projects, such as the introduction of energy-efficient equipment, deployment of renewable energy, and proper forest management. |

| Joint Crediting Mechanism (JCM) | The JCM is a system that quantitatively evaluates contributions to GHG emission reduction or absorption by promoting advanced decarbonization technologies and products in developing countries. The credits generated under this mechanism can be used by both Japan and its partner countries to achieve their Nationally Determined Contributions (NDCs) in alignment with the Paris Agreement’s 1.5°C target. |

| Voluntary Credits | In Japan, an example of voluntary credits is the J-Blue Credit, which is managed by the Japan Blue Economy Association (JBE) and focuses on certifying carbon absorbed and stored by marine ecosystems (Blue Carbon). Internationally, key private-sector voluntary credit standards include the Verified Carbon Standard (VCS), Gold Standard (GS), American Carbon Registry (ACR), and Climate Action Reserve (CAR). |

Carbon credits can also be classified based on the nature of the efforts undertaken for certification. These classifications include:

Certification Requirements and Considerations for Carbon Credits

Currently, there is no standardized set of certification requirements for carbon credits, and each system establishes its own criteria.

The International Carbon Reduction & Offset Alliance (ICROA), an industry organization, has defined general principles for high-quality credits, including Real, Measurable, Permanent, Additional, Independently Verified, and Unique. Some voluntary credits comply with these requirements.

In addition, in 2023, the Integrity Council for the Voluntary Carbon Market (IC-VCM) introduced the Core Carbon Principles (CCP), which set forth requirements for high-quality carbon credits. The Voluntary Carbon Markets Integrity Initiative (VCMI), an NPO established by the UK government, also released the Claims Code of Practice.

Given this transitional phase, where multiple organizations are working toward standardization, it is not necessarily required to ensure that a carbon credit transaction fully complies with all existing standards. Instead, it is crucial to assess whether the carbon credit serves its intended purpose and to consider any relevant risks.

For example, if a company purchases J-Credits for the purpose of regulatory reporting under the Act on Promotion of Global Warming Countermeasures, there should be no particular issues.

However, if a company enters into a long-term agreement to continuously purchase carbon credits while supporting their generation, it should consider factors such as potential changes in legislation, amendments to certification requirements, and the possibility that certain credits may be phased out due to standardization.

As the global push toward achieving carbon neutrality by 2050 accelerates, Japan has also taken steps to establish a carbon credit framework.

In February 2021, the Ministry of Economy, Trade and Industry (METI) launched a study group to explore economic mechanisms for achieving global carbon neutrality. This group aimed to clarify the role of carbon credits and formulate policies for establishing a carbon credit market. To facilitate more concrete discussions, the Carbon Credit Study Group was established, and in June 2022, the Carbon Credit Report was published.

The Carbon Credit Report examined key challenges and specific policy measures from the perspectives of demand, supply, and distribution. The developments following its publication are summarized below.

One of the key challenges in Japan is that, despite the existence of various types of carbon credits, their legal and institutional positioning remains unclear. This lack of clarity has led some companies to hesitate in utilizing them.

To address this issue, the report suggests that it is essential to clarify usage methods and promote the proper disclosure of the value and characteristics of carbon credits.

Following the report’s publication, initiatives such as GX-ETS (a voluntary emissions trading system introduced in April 2023 under the GX League) have emerged. Under this system, companies can use qualified carbon credits—such as J-Credits and JCM Credits—to meet their targets. As suggested in the Carbon Credit Report, additional carbon credits may be recognized as eligible in the future, potentially driving further demand growth.

From a supply perspective, one key challenge is that carbon removal technologies such as Direct Air Carbon Capture and Storage (DACCS) and Bioenergy with Carbon Capture and Storage (BECCS), as well as nature-based carbon sequestration methods such as soil carbon storage in farmland, are not eligible for certification under the J-Credit system. As a result, there is currently no mechanism to promote these methods through carbon credit issuance.

To address this, the report highlights the need to develop schemes that facilitate the creation of carbon sequestration and removal-based credits outside the J-Credit framework.

Following the publication of the report, initiatives have been launched to develop new certification methodologies and revise the J-Credit system, aiming to expand the issuance of forestry-based and sequestration-focused J-Credits.

On the distribution side, while many countries are establishing carbon credit exchanges and trading platforms, Japan still relies primarily on over-the-counter (OTC) transactions. Additionally, trading volumes and prices lack transparency, making it difficult for project developers to assess investment recovery and for credit buyers to forecast procurement costs.

To address these challenges, the report emphasizes the importance of:

Since the report's publication, Japan has taken a significant step by launching a carbon credit market on the Tokyo Stock Exchange in October 2023. However, this market currently only handles J-Credits, and trading volumes remain limited. The number of private trading platform operators is also increasing, indicating a growing market. Moving forward, further discussions will be needed to enhance market liquidity, including clarification of legal, accounting, and tax frameworks.

The legal treatment of carbon credits remains unclear, making it essential to exercise caution when designing services involving carbon credits or engaging in carbon credit transactions. Consulting a lawyer can help ensure compliance with evolving regulatory frameworks and mitigate potential risks.

ZeLo excels not only in traditional corporate legal services, such as litigation and dispute resolution, but also in cutting-edge fields such as Web3 and AI, as well as emerging business models. We provide comprehensive support for carbon credit developers and carbon credit trading platform operators, including regulatory advocacy through our Public Affairs team to engage with regulatory authorities.

We also have strong expertise in fundraising support for new businesses and assisting with investments and acquisitions involving carbon credit developers and trading platform operators.

Our team provides tailored and flexible legal advice based on the specific needs and business models of our clients. Please feel free to contact us for further discussion.

Please let us know if you have further questions or may need assistance on this matter. For further information on the above, about our firm or any other matters, please contact through the form (https://zelojapan.com/en/contact).

The information provided in this article does not, and is not intended to, constitute legal advice and is for general informational purposes only. Readers of this article should contact an attorney to obtain advice with respect to any particular legal matter.